30 years ago the financial planning industry was just starting to find its feet. In these early days of the industry financial planners differentiated themselves from the agents of the big Mutuals by selling a range of unit trusts being offered by what we would call boutique managers like AustWide, Growth Equites Mutual, EquitiLink and Global Funds Management along with the soon to be notorious Estate Mortgage.

Remuneration was different then too. An upfront investment fee of up to 6% was charged and generally 4%-5% commission was paid to the adviser selling the product with the rest retained by the Fund Manager. While this might seem crazy, don’t forget that inflation was running at around 8% so clients could usually expect the entry fee to be picked up in first year via normal asset appreciation (or so they were told!).

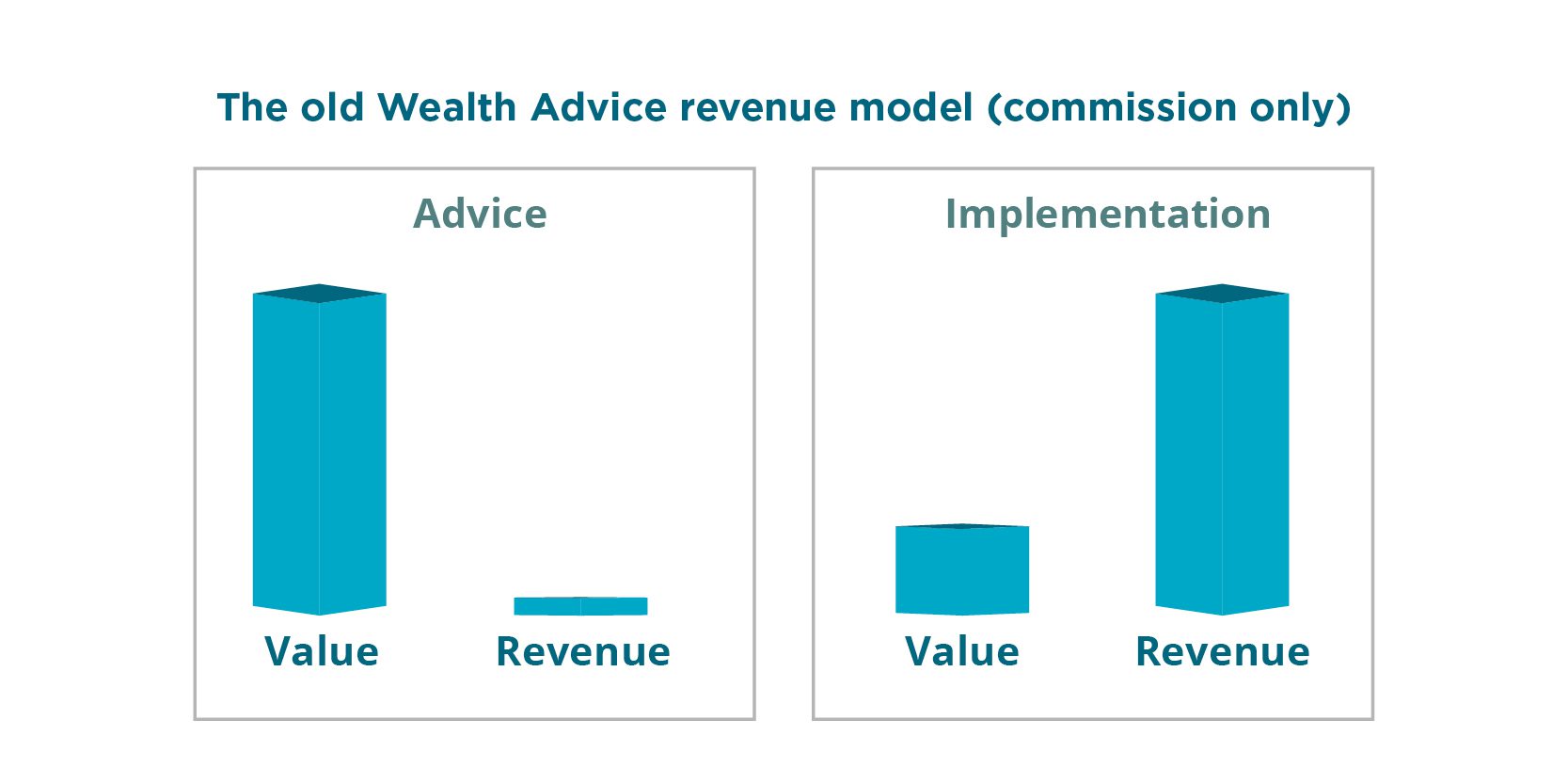

The advisers would prepare a financial plan outlining the Funds the client should buy. Rarely would a plan fee be charged, essentially the plan was done “for free” and then the adviser would get their payment once the client bought the funds. This could result in product recommendations being delivered but never implemented as clients shopped around for planners, some of whom might discount their .

Gradually advisers saw the imbalance of giving away their intellectual property for free and then being paid for the implementation as this simply involved filling in the application forms inside the prospectuses. As a result, some started to introduce a plan fee and then dial down the commission to make sure their efforts did not go unrewarded.

To a large extent this model worked because clients had very limited options to go direct to fund managers or access funds without upfront fees. No fund manager would discount the entry fee to direct clients for fear of alienating advisers.

It was only when discount (no advice) brokers came along that clients had a cost-effective way of going direct. This showed that the implementation costs were negligible as their model was usually based on rebating all up front commissions but retaining the trail. The minimal implementation costs could be absorbed, and a nice annuity stream built as a result.

In the old wealth management sales model at least 95% of the adviser knowledge and effort being given away for free and then the completion of a few applications saw them being paid $4,000 on a $100,000 investment.

It became clear that it was much better to charge for the value of the advice being delivered not just the implementation of the solutions.

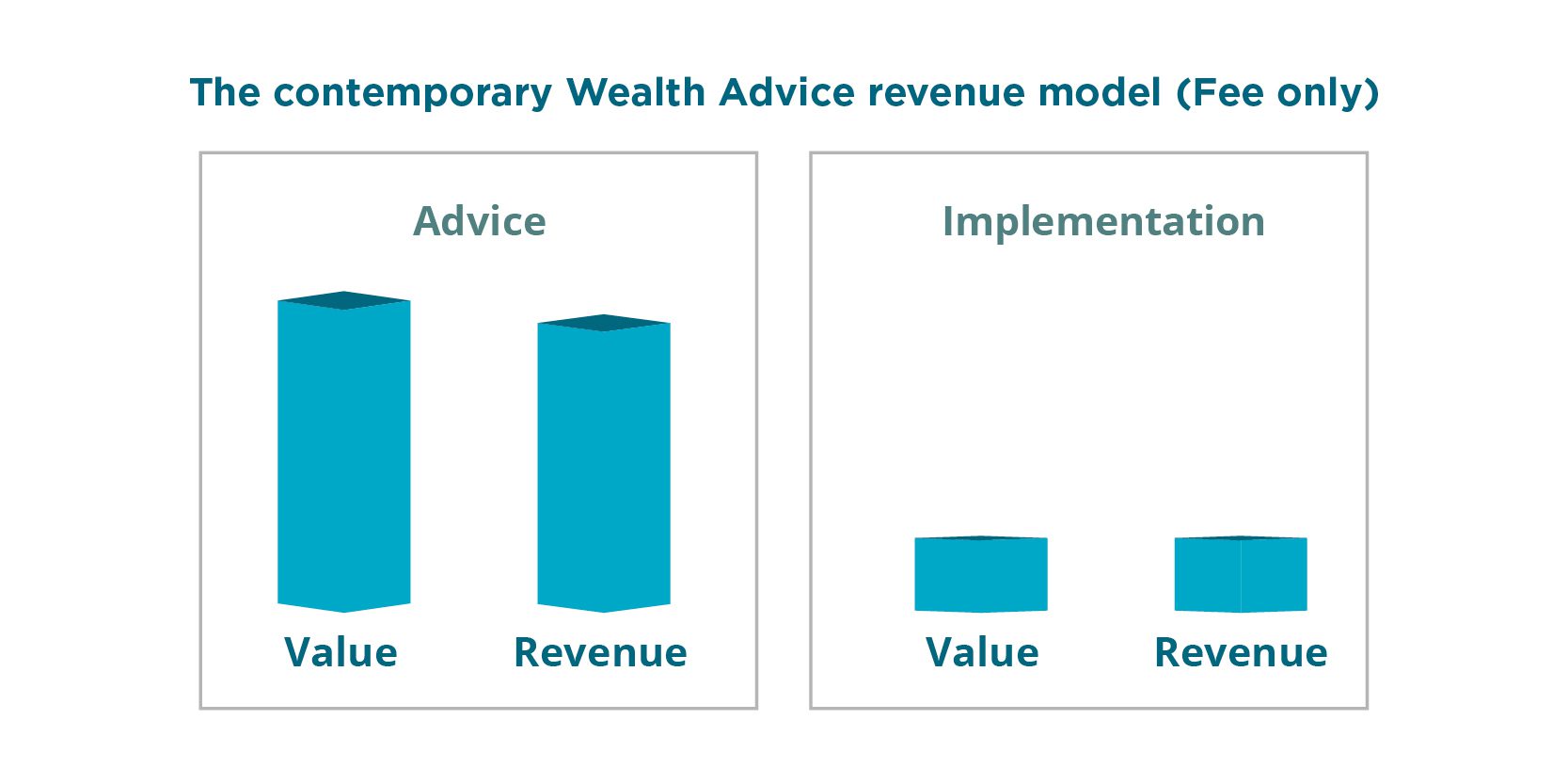

As the industry matured and through a combination of market forces and legislative change we have moved away completely from commissions on wealth products, with the last vestiges of that model disappearing with the termination of grandfathered commissions.

This shift also reflects the evolution of advice to be about much more than just the establishment and monitoring of an investment portfolio. Advisers are now dealing with issues well beyond just the investment portfolio with advice being provided on issues such as cashflow, estate planning, and achievement of a broad range of personal goals.

So, with changes in remuneration for life insurance flowing through the industry what are the similarities and differences between the sale of wealth products and insurance products and what does this mean for advice practices?

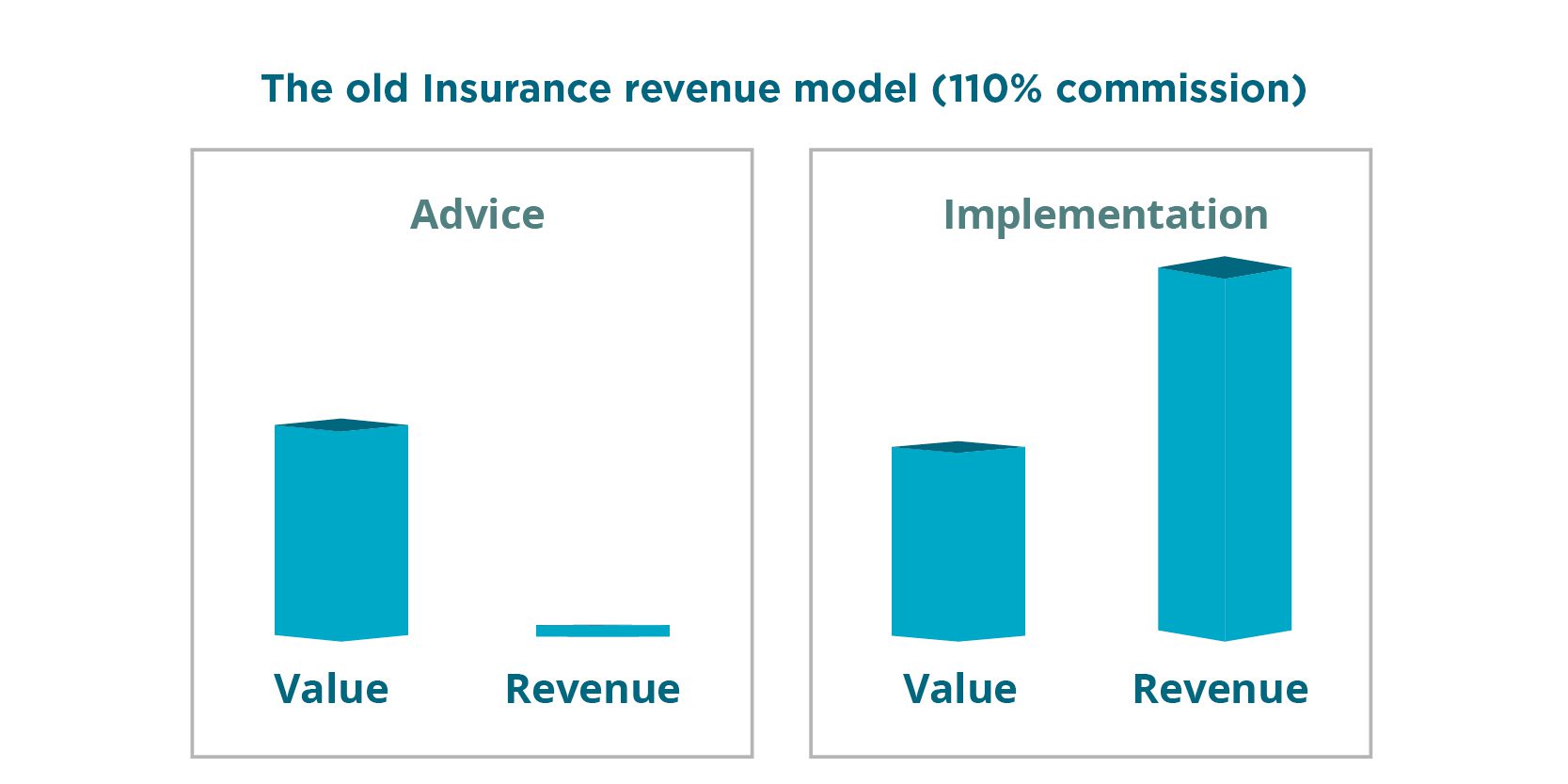

In part, where it is purely a life insurance recommendation, the same issue applies of advisers developing a Statement of Advice “for free” and then being remunerated for the resulting product sale. Where the difference lies, is that the implementation process for insurance is much more involved than investing in a managed fund.

The adviser is charged with the responsibility of collecting a lot of the personal information the life office needs in order to underwrite the business and helping shepherd the client through the underwriting process ensuring medicals are completed and other requirements fulfilled.

The fact that the groups providing direct access to insurance through retail comparison sites generally retain all the commission reflects the costs they incur in getting the insurance placed and client underwritten is significant.

Unlike wealth management a significant proportion of the effort does relate to the implementation of the advice when insurance is being written. Completing quotes, applications, personal statements and then helping navigate underwriting requirements and then often a need to discuss and review revised terms all takes significant time.

The good news is that these acquisition costs are covered by the life company and paid to the adviser in the form of commissions. The life company is building these acquisition costs into the premiums and then amortising them over the anticipated life of the policy, usually budgeted as 7 years.

So what does this mean for advisers providing Insurance only advice?

My view is that the current model of commission suffers the same flaw as the early wealth management model. The valuable IP is being given away and all the remuneration is being associated with the acquisition costs.

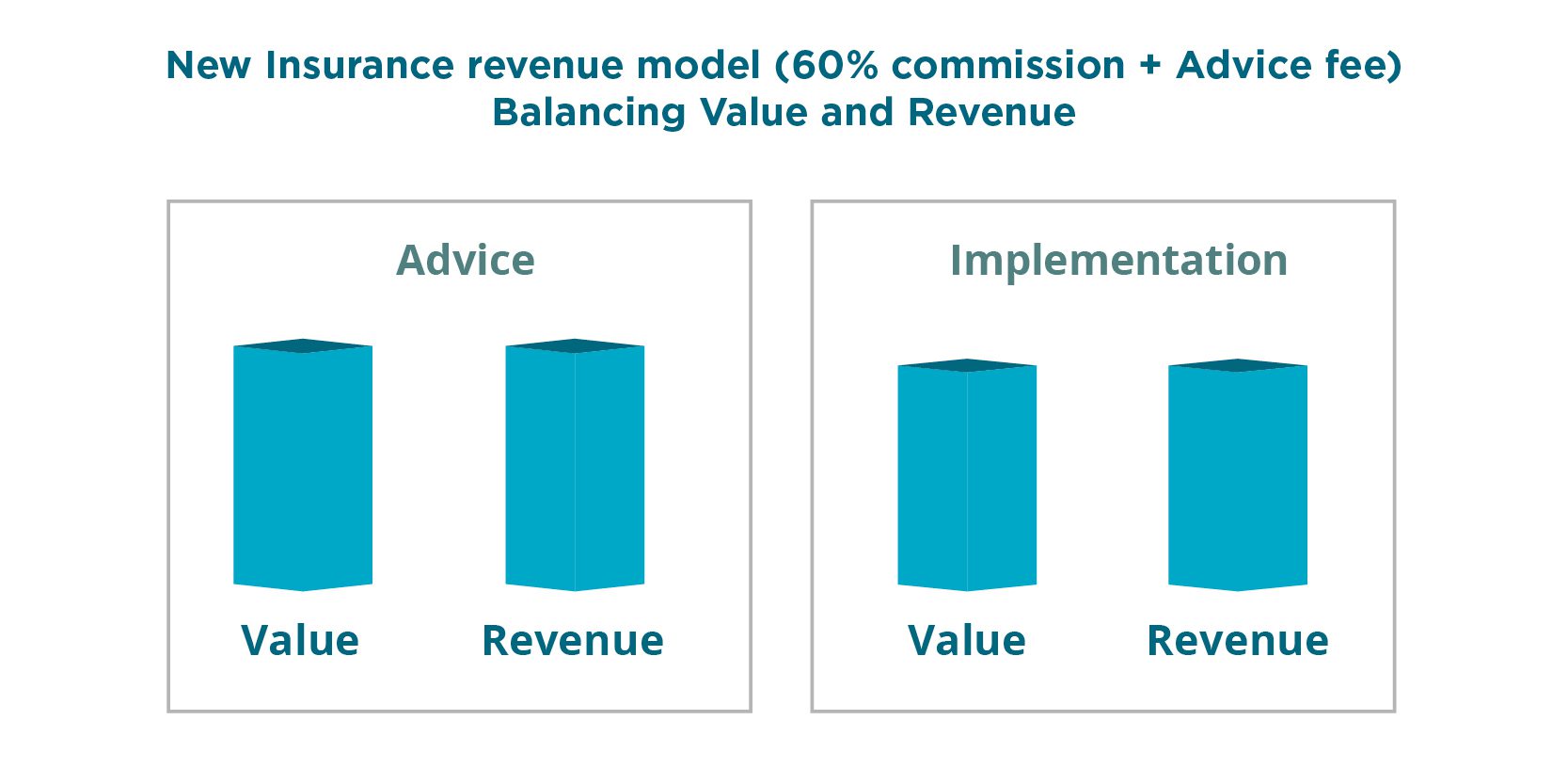

An alternative solution is to price out the cost of creating and delivering the advice and charge for this accordingly. This would normally involve completing the fact find, assessing the clients circumstances, conducting a health pre assessment, the analysis determining where the client’s greatest potential risks and liabilities lie and then creating a portfolio of insurance solutions that appropriately address these risk factors while being aware of affordability and other client objectives. All structured in the most effective way to suit the client.

Once the plan is accepted and the insurance solutions agreed the adviser can implement the solutions. And this where the key difference lies because the cost of implementation is significantly greater than implementing a wealth portfolio. To get the insurance in force the adviser needs to take the client through the steps necessary to get the insurance accepted by the insurer. For this the adviser will receive the commission from the Life Companies providing the insurance.

What if the 60% rate of commission is materially more than the anticipated costs of implementation? In this situation the adviser can consider reducing the rate of commission with a corresponding reduction in premiums for the client with the advantages this would provide in premium savings and likely long-term product retention.

And here’s the challenge – at 60% of the annual premium, many advisers are finding that the commission is in fact materially lower that the costs of providing and implementing the advice. Today’s advisers need to be clear on their cost to serve on a client by client basis and then ensure that the revenue covers the costs with the required profit margin included. By pricing the advice and charging appropriately for this the adviser is making it clear that their advice and strategy is of real value to the client. The adviser can then be clear that the commission being received is to cover the costs of the support provided in getting the cover in place.

Practices that adopt this model are taking back control of their remuneration and profitability rather than hoping the that external influences like LIF don’t damage their business. And as we know, hope is not a plan!